8+ Irs Installment Agreement While In Chapter 13

If you have high IRS balances owed more than 50000 then a Chapter 13 filing will prevent the IRS from scrutinizing your income and expenses. If ALL the income tax debt in your present monthly payment plan is dischargeable Chapter 7 likely makes sense.

3 11 154 Unemployment Tax Returns Internal Revenue Service

Youd not have to pay anything.

. An irs installment agreement is of particular benefit to those who have filed for chapter 7 bankruptcy. Call the Law Office of David. Chapter 13 stops the IRS from charging you interest while you make your payments.

The interest you already owe the IRS can also be reduced by bankruptcy law. When Chapter 7 Makes Sense. With an IRS installment agreement you generally need to be able to pay the tax debt penalties and interest in full within 72 months.

Now that the April 15 th tax filing deadline has passed many tax debtors are facing the dilemma of how best to pay past due tax liabilities and are weighing the advantages of a chapter 13. The Collection Statute time period will continue to run while in Non-Collectible Status but the IRS will record a Notice of Federal Tax Lien. Payments for tax debts are made in the same manner as all general.

Posted on Jan 8 2014 Selected as best answer Because of the automatic stay the IRS cannot require you to keep making the payments while the stay is in place. As a general rule the Bankruptcy Trustee and. That gives you a little more time than the.

PPIAs usually last until the end of the 10-year collection statute. This is the deadline to collect. As the last thing you need is to be exposed to renewed IRS collection activity the benefit of having a properly structured IRS Installment Agreement is critical.

If this is IRS debt that came due after the Chapter 13 case was filed the Trustee MAY BE willing to allow the payment plan to continue and you should consult with your. A partial payment installment agreement PPIA is a long-term payment option. You may have longer to pay the tax debt through Chapter 13 than through an IRS installment plan depending on how much time you have left on your install agreement Some.

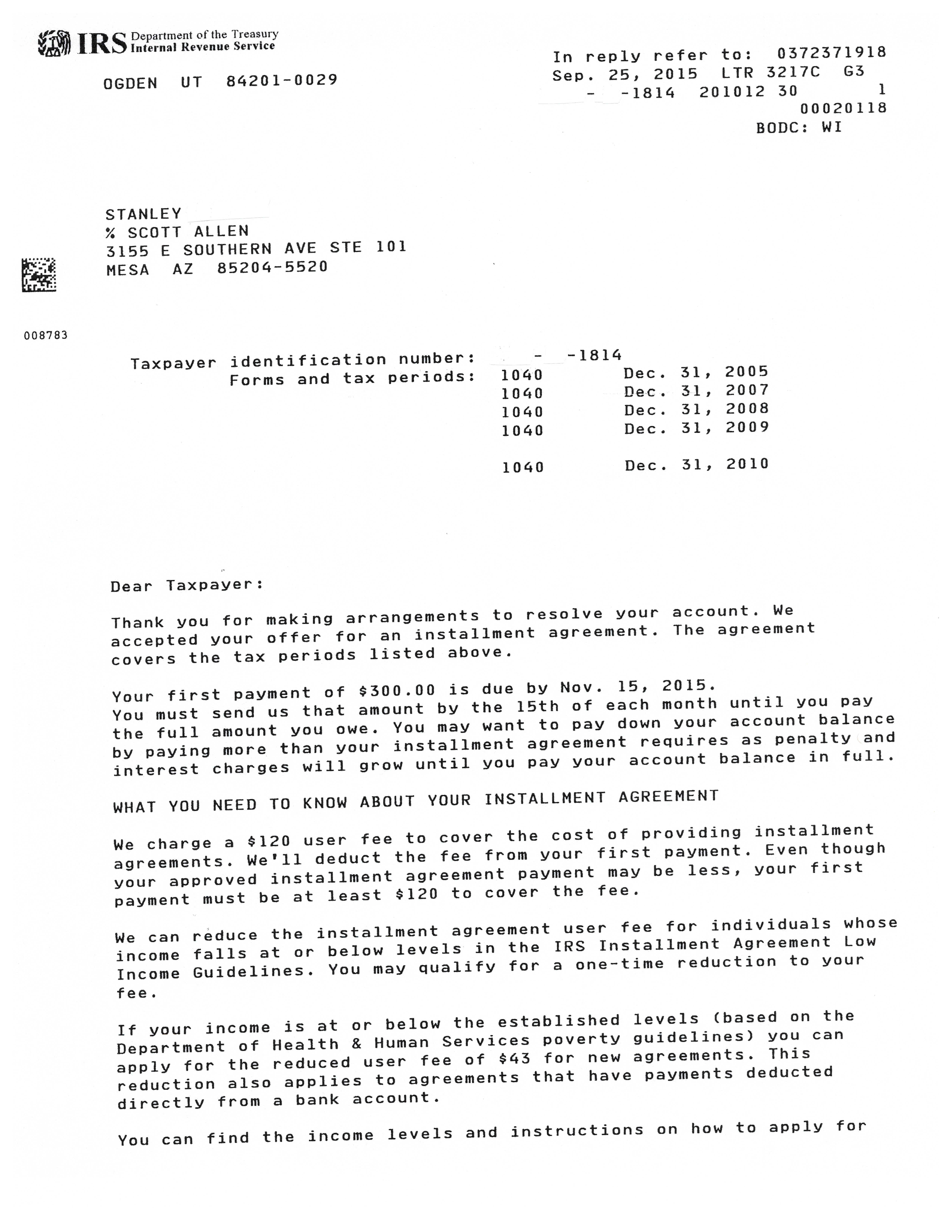

Individuals can complete Form 9465 Installment Agreement Request If required in the instructions please attach a completed Form 433-F Collection Information Statement PDF. Tax obligations while filing Chapter 13 bankruptcy. Chapter 13 bankruptcy is only available to wage earners the self-employed and sole proprietor businesses.

Under a Chapter 13 plan if the five criteria are satisfied tax debts are treated as general unsecured debts.

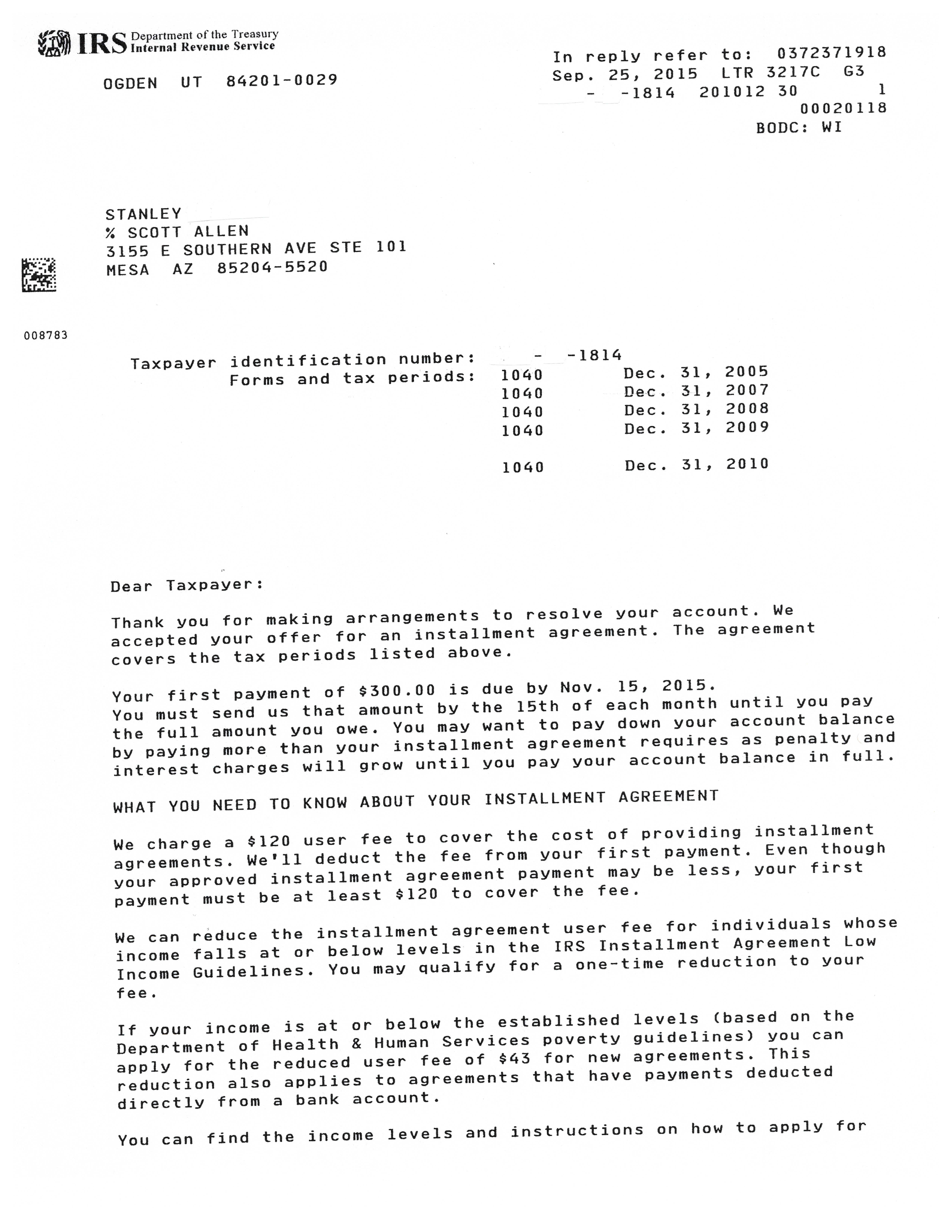

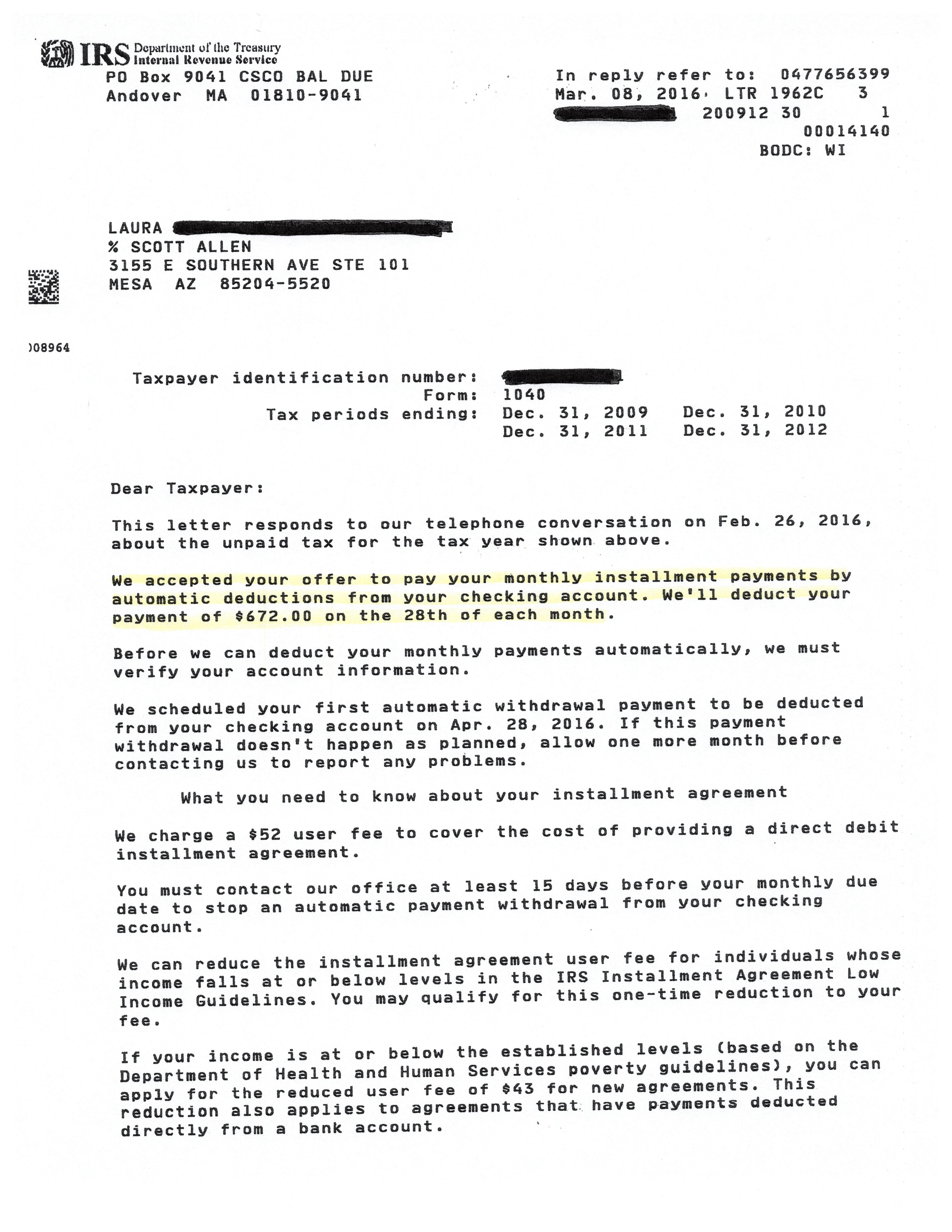

Mesa Az Irs Payment Plan Accomplished Tax Debt Advisors

What To Do If You Receive Irs Notice Cp523 Youtube

Form 9465 Installment Agreement Request Jackson Hewitt

Installment Agreement With Irs While In Chapter 13 Legal Answers Avvo

Kaiserslautern American June 8 2018 By Advantipro Gmbh Issuu

3 17 79 Accounting Refund Transactions Internal Revenue Service

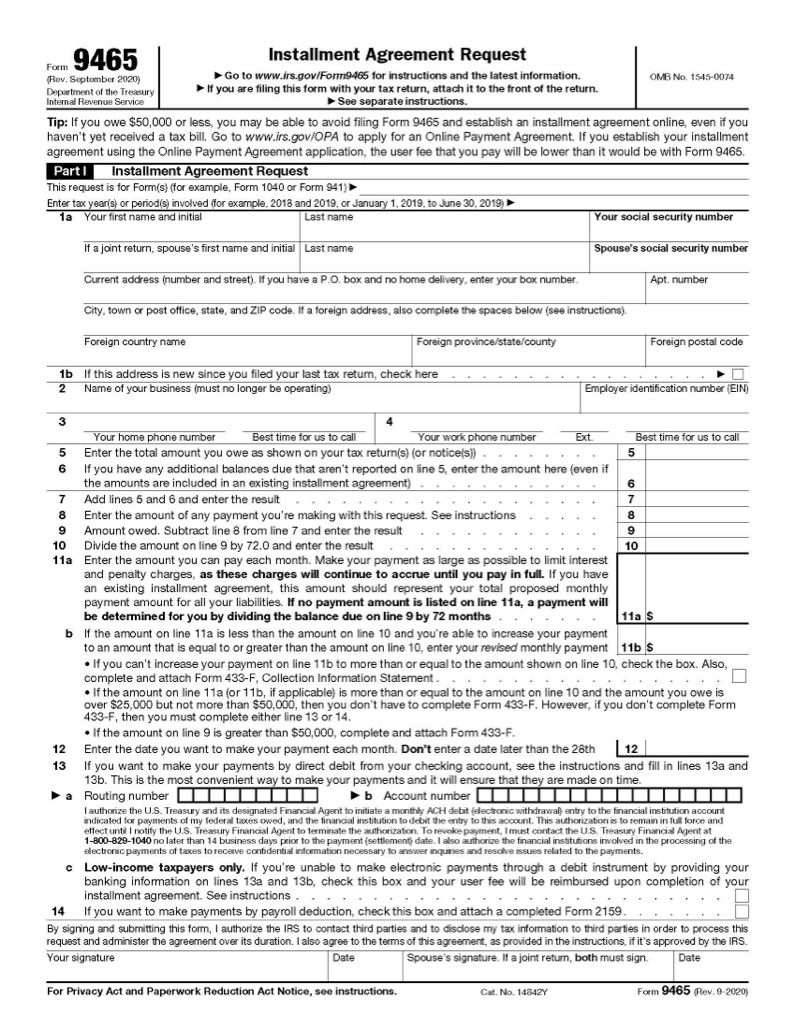

Sal And His Mesa Az Irs Installment Arrangement Tax Debt Advisors

Installment Agreement With Irs While In Chapter 13 Legal Answers Avvo

50 Years Of The Berlin Tv Tower Tv Turm

3 12 22 Employee Plan Excise Tax Returns Internal Revenue Service

Installment Agreement Tabb Financial Services

If I File Bankruptcy Do I Still Have To Pay An Irs Installment Agreement Youtube

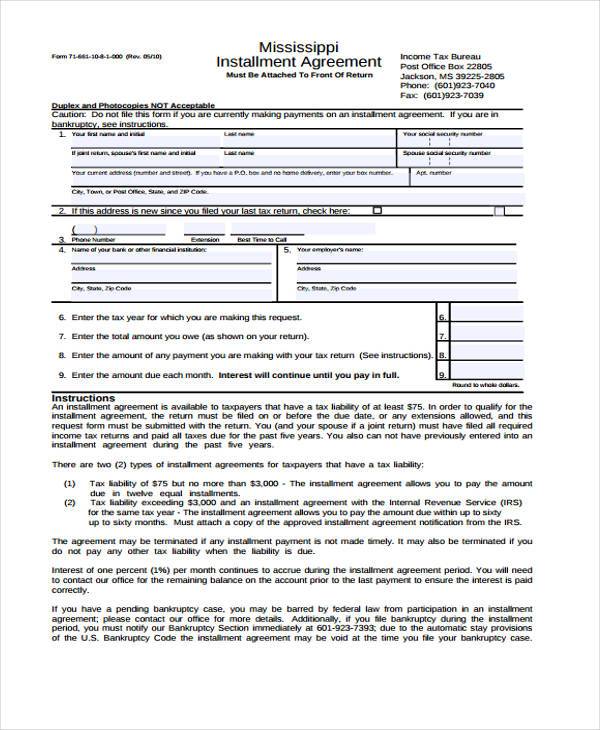

Free 8 Installment Agreement Form Samples In Pdf Ms Word

Form 433 D Installment Agreement

I Am In Chapter 13 And I Owe Taxes That I Cannot Pay In One Lump Sum Can I Go Into An Installment Agreement With The Irs Legal Answers Avvo

Irs Payment Plan Specialists Chandler Tax Debt Advisors

G310552ka05i006 Gif